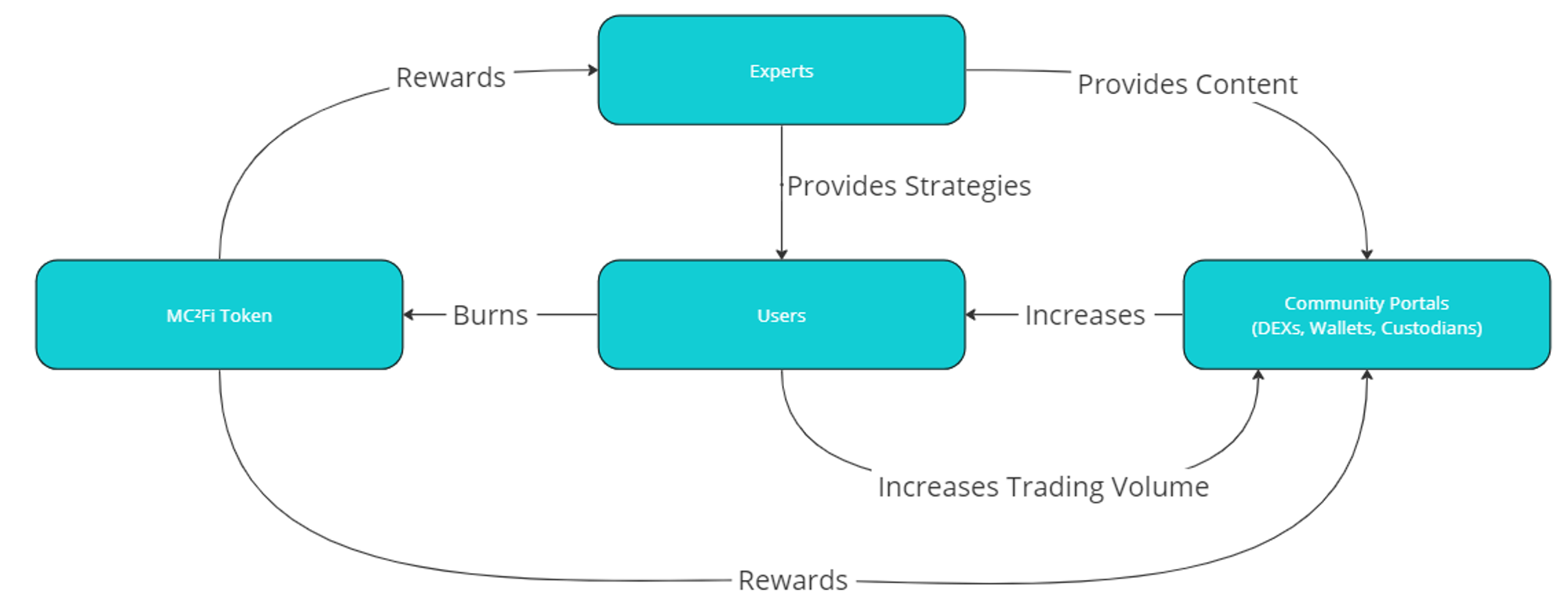

MC² Finance is a Web3 protocol that offers a comprehensive suite of core components and features to democratize the digital asset management landscape. Designed to meet the needs of both retail and institutional investors, MC² Finances’ non-custodial, shareable, and cross-chain pool-technology democratizes token strategies through the protocols marketplace.

Features:

→ Easy integration into DEXs, including the option to white-label technology. → Access, learn, and benefit from an array of competitive, rated DeFi portfolio strategies. → Access social clubs to innovative exclusive content & strategies. → Standards and methods for Rating DAOs for Institutional grade certification.

Core components and features

Non-custodial cross-chain crypto pools

The MC² Finance core Pool Technology standardizes pools cross-chain, making portfolio funds secure and accessible across all chains through MC² Finance’s AMM. Any strategy can be wrapped in a pool with a simple accruing token. The accruing token can be listed, shared, traded, or bridged. The pools are visible to the MC² Finance marketplace.

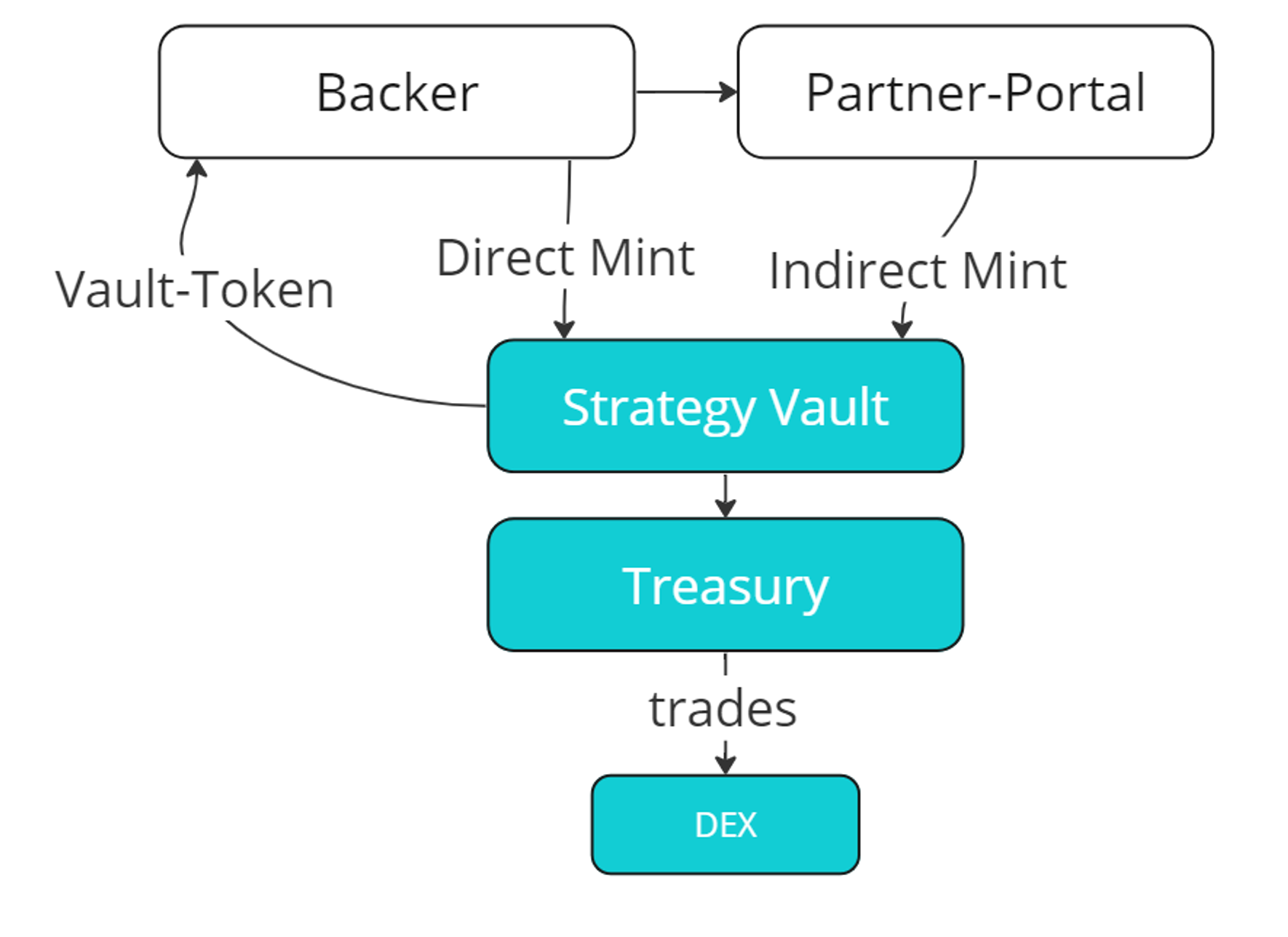

Each Pool² features its own ERC-20 token, making it easily tradable by Users². Users² provide the collateral defined in the strategy to mint the token. MC² Finance’s StrategyOracle² publishes the underlying statistics about the performance of this strategy, which mimics the underlying trade strategy for the Pool². Furthermore, our economic engine is observing the trades in the background, preventing bad actors and signaling risky actions until the underlying collateral is collected by the User² and the Pool² token is burned.

DEX integrations, APIs and widgets

With the intention of widespread integration of MC² Finance strategies and forwarding the standardization of token-sharing strategies, MC² Finance welcomes integrations for DEXs, APIs, and widgets, including the option to white-label technology. We are cross-chain and thus, protocol and network agnostic. The technology is optimized to integrate with customers from DEXs, Wallets, Custodians, DAOs, NFTs, Protocols, Launchpads, and Dapps to Institutional Customers.

With white-label integration, MC² Finance becomes the third menu option on a partnering DEX. For example, DEXs can easily insert the “Strategies” integration button linking directly to MC² Finance’s expert portfolio strategy marketplace next to “Earn” and “Swap” in their main menu.

*Focus is on DEX integrations, see DEX Partner Program.

DeFi tokens for strategies

MC² Finance testnet pursues a spot-token strategy to prove cross-chain technology. By the mainnet launch, MC² Finance will support an array of DeFi-tokens improving the intricacy and available opportunities for token strategies and appreciative tokens.

How it works:

DeFi strategies are wrapped in a single pool, enabling complex DeFi models to run. The strategy may initiate several interactions such as the daily retrieval of earnings to be automated from multiple staking and lending platforms resulting in a single appreciative token. Turning a full, complex strategy into a simple ERC-20 token that can be stacked, integrated, and bridged throughout the Web3 ecosystem.

Future State:

With proof of returns, MC² Finance has a case to actively seek partnerships that allow our strategy-pool-tokens to be used as collateral for DeFi protocols for activities like lending.

Basic flywheel

Social club tokens for experts and ratings

Social Club Tokens provide a means for traders to connect, collaborate, and learn from one another, with the goal of improving their trading performance and achieving their financial goals, as well as token-gating strategies for regulatory requirements.

Certain Expert² and User² strategies only work with a limited amount of Users². Rating DAOs have a unique perspective on standards, regulations, and knowledge on which DeFi strategies are beneficial for certain user groups and members, such as institutional investors. MC² Finance’s social-club tokens act as gateways for Experts² and Rating-DAOs to define and curate audiences for their Expert Strategies².

To access a social club, members lock MC²Fi tokens. The amount needed to mint 1 social-club token grows by the number of tokens minted (via a bonding curve).

→ Every 10 tokens minted = 1 token minted for the social-club creator (inflation). → Users can burn social-club tokens anytime to retrieve locked MC²Fi tokens. → The social-club tokens are asset-backed and don’t require liquidity management.

**Requests from Experts and DAOs to create a social club for DeFi Strategies on MC² Finance can be made explicitly through the portal.

Strategy rating DAOs

Traditional finance has established several structures to qualify and assess financial products. This is a crucial quality assurance aspect of digital asset management to ensure transparency and integrity of the financial system. To verify the quality, strategy, and integrity of financial products, rating agencies periodically perform internal and external manual audits.

With the technological advancements of the blockchain, this process can be fully automated by audit codes. MC²Finance can enable such audits. MC²Finance is able to execute automated audits on every transaction an Expert² is performing and if the audit deems the transaction is performing a violation can stop execution.

Example: When an expert modifies their strategy, the DAO's audit code runs to ensure compliance is being followed with the established guidelines. For instance, if an ESG DAO verifies and lists 250 tokens under a certification and a trader seeks this certification, they can only trade these 250 designated tokens. Any attempt to trade outside this range will be disallowed in real time, safeguarding the follower's assets and guaranteeing adherence to the strategy.

Auditor Process

Experts Strategies² apply for audits and auditors are informed. The auditor goes through their manual process (for now). For example, to conduct an interview with the Expert² to verify their knowledge and concept, before approval. After approval, the Auditor² assigns custom audit codes to the strategy. In case of a violation, the Auditor² is informed and able to perform further action to improve the quality of the strategy.

*Auditors can apply to become designated through an application process. Auditors have the authorization to create special tags & categories and provide standards for their audits and validations.

Technology stack

The MC² Finance technology stack is interoperable, scalable, robust & secure. MC² Finance’s AMM, APIs, and widgets bridge its marketplace on top of fundamental blockchain tech stacks in the Web3 industry (ie. Layer 1’s and 2’s - Ethereum, Polygon, or lending platforms such as AAVE).

High-level on-chain and off-chain components:

Onchain → Escrow, Treasury, Permits, AMM (cross chain) Offchain → ExpertsOracle, StrategyOracle, ClubOracle, EE (EconomicsEngine), SocialFeeds, Notifier, Policies

Tokenomics

MC²Finance is currently evaluating different concepts, our full tokenomic structure will be released at a later date. See the tokenomics distribution outline in the figure below.

MC²Finance will feature several token classes:

MC²Fi token, MC²Finance central token

Pool-Tokens, per strategy per chain

Social-Club tokens, per expert or auditor

MC²Gov token governance token

Governance model

MC²Finance will be a DAO governed by the Mc²Gov token leveraging a quadratic voting operational structure. While the core team is governing the early phases of the protocol, operations, and systems are being built toward decentralization.

The Mc²Gov token can be minted by staking the MC²Fi token into a special Pool². This Pools²’ treasury invests a part of the collateral into the best-rated Expert Strategy² pools. During the vesting phase, a special contract locks vested MC²Fi tokens to retrieve Mc²Gov tokens.

Quadratic voting will ensure democratized decision-making. Voting delegation is possible, however heavily regulated and on the condition of periodic renewal.

LeadershipChallenges and risks

MC²Finance’s opportunity to present actionable, transparent strategies and support democratized participation for web3 newcomers, crypto natives, and even institutions is not without challenges and risks. While we import proven digital asset strategies from traditional finance to an open marketplace with new technology there are some considerations. It would be hypocritical if these were not addressed 🙊…

Challenges and Risks:

→ Establish privacy and security methods and evaluations of partners for cross-chain DeFi bridging → Develop standards for evaluating partners and integrations for strategies → Partnerships with the best DEXs and chains to scale → Requirements for institutional capital to utilize MC²Finance strategies → Onboarding the best Experts to create high-quality strategies → Decentralized decision-making through DAO management (deciding how portfolio strategies are managed, social gating, evaluation)

Market rollout in 3 waves

To optimize the rollout MC² Finance focuses on 3 phases

Wave 1 | Wave 2 | Wave 3 | |

Distributor | DEXs | Whales & Chains | Custodians & Institutions |

Focus | building Crosschain Pools | DeFi protocol integrations to increase yield | Realtime Auditing and Compliance |

USP | Global Marketplace | private & exclusive non-custodial strategies | Fast integration, DeFi Realtime Asset protection |